Covid-19 and emerging economies: What to expect in the short- and medium-term

As Brazil, Russia, India and Mexico record the fast spread of the Covid-19 contagion, a third wave of the pandemic is reaching the emerging world. As a result, business sentiment has decreased in March and April in the region. What’s more, as emerging economies gradually moved towards tighter mobility restrictions, the lack of mobility is set to weigh on the economic outlook. In fact, the International Monetary Fund (IMF) is expecting the emerging world to enter a recession of -1 percent in 2020, which could be worse than the aftermath of the global financial crisis in 2008.

Beyond the pandemic, the emerging market is particularly fragile as two more shocks are hitting the region. The first is the collapse in global oil prices, pushing down external and fiscal revenues for emerging oil exporters aggressively. As if this were not enough, the rapid spread of Covid-19 brought about a sudden increase in global risk aversion and lifted emerging market financing costs, given their dependence on external financing and the inability to issue hard currency. Among emerging economies, the Latin American region is much more fragile, given its fast increase in debt levels and high dependency on commodities as well as external financing.

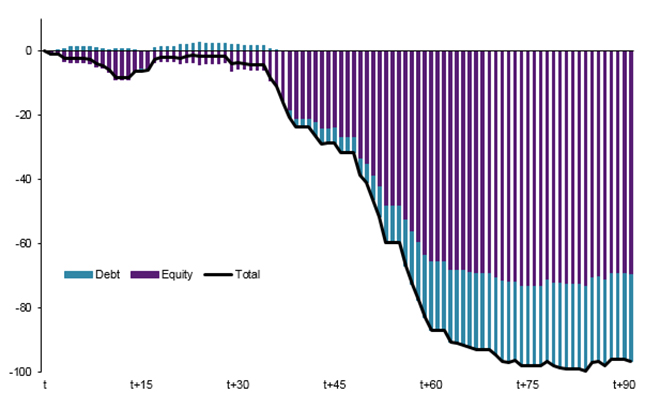

As risks in the emerging markets heighten, the capital outflow emerging economies has been unprecedented. Also, exports—especially commodity exports—have collapsed and revenue from international tourism has plummeted in the light of travel bans. Against such backdrop, the IMF estimates that total gross financing need of emerging markets could be as much as US$2.5 trillion.

Accumulated non-resident portfolio flows to EM since Jan-21 2020, in $ bn

The most immediate way for emerging economies to protect themselves from the external financing shock is to use domestic policies, both monetary and fiscal. Unfortunately, the fiscal room tends to be limited. As for monetary policy, currency pegging to dollar for some countries and weaker currencies in light of massive capital outflow for the other have also capped the policy room. The obvious shortcut is to introduce capital controls, however, such measures risk immediately pushing investors away with serious consequences for dollar liquidity and, thereafter, growth.

As such, there is a need to look other tools to address the impact of Covid-19 on dollar funding but they are also hardly adequate. The first line of defense is domestic forex reserves but such self-insurance tends to concentrate in Asia and the Middle East only and few economies can safely claim that their reserves are enough. Another tool lies in regional insurance schemes, which again tend to concentrate in Asia, with a set of bilateral swap lines since the 1997 Asian financial crisis which has been increasingly multilateralised into the so-called the Chiang Mai Initiative Multilateralization. On the other hand, other regional insurance mechanisms have been largely discontinued after the crisis they were created for waned, leaving troubled regions such as Latin America under-protected.

Beyond self and regional insurance devices, the US Federal Reserve has expanded its existing bilateral swap lines with a selected group of central banks. However, only two of the central banks are in emerging economies, Brazil and Mexico[1] with two additional cases depending on how emerging markets are defined, namely South Korea and Singapore. To this end, it seems clear that the Federal Reserve will not become a lender of last resort of the emerging world. However, the best candidate to play that role—the IMF—suffers from lack of resources, leading to significant risk where smaller, but poorer emerging economies cannot access IMF funding at a time where their debt is increasing.

Apart from the short-term impacts on fiscal sustainability and dollar access, Covid-19 will also have several important structural consequences on emerging economies. First, supply disruptions have questioned the global supply chain model and its over-dependence over China. Over the last decade, the world has become more dependent on China’s intermediate exports, but China’s vertical integration has driven down its dependence on foreign inputs, meaning that the world is even more exposed to China. In light of the significant concentration risk, governments such as Japan and the US are starting to advise their companies to re-shore or near-shore their production away from China. It is conceivable that distance to production will be shortened and that the most important part of production, on a strategic basis, will be redirected to their places of origin.

Such reshuffling of global value chains can be opportunistic for emerging markets. Other than nearshoring to ASEAN, with Vietnam as the main winner so far, one can think of nearshoring to Mexico for the US and Canada and to Eastern Europe for Northern and Central Europe. Within Asia, India is also likely to capture some of China’s labor-intensive. For medium-tech and capital-intensive manufacturing, Thailand is best positioned thanks to the best in class general business environment and infrastructure with Malaysia also strong in competition.

Another important change will be the reduction in people to people mobility with a massive impact on certain sectors, such as airlines and tourism due to stricter border controls and mobility restrictions. This will impact emerging economies that are heavily dependent on tourism for sources of income and growth, such as Thailand and the Philippines.

Finally, strategic competition between the US and China will only increase as a consequence of Covid-19. From trade and technology disputes, we are moving towards new areas of confrontation, from the diplomatic spat involving the role of the World Health Organization in the spread of the pandemic as well as that of China to increasing decoupling of investment and finance. On this basis, the chances of global policy coordination have trended low, which makes the fight agains Covid-19 less effective. Furthermore, an increasing number of countries will be forced to take sides in a world which is decoupling and heading towards a new form of Cold War.

Alicia García Herrero is a member of the GLOBE Advisory Board and a Senior Fellow at European think-tank BRUEGEL.

Article published in "Observer Research Foundation (ORF)" on May 21, 2020

[1] It should be noted that Mexico, as well as Canada, have access to one more dollar swap line with the FED in the context of NAFTA but they account to a couple of USD billion and, thus, too small to be paid much attention.